Three of this election cycle’s biggest catchphrases belong to energy. Candidates on both sides of the aisle speak of the need for a “level playing field,” an “all-of-the-above energy strategy,” and a plan that does not “pick winners and losers.” While they may agree on the rhetoric, they usually don’t agree on what the terms mean in practice. One of the areas where the two candidates have significant policy differences relates to subsidies – the assistance given by the government to energy sectors, either by a direct award/grant or tax breaks/deductions. Should renewable energy get government money to help it along? Fossil fuels? Both? How much?

A simple and alluring answer to the “level playing field” issue (actually, to all 3 catchphrases) is, “let’s get rid of all energy subsidies.” If neither side gets help or advantages from the government right now, it must be fair, right? Unfortunately, this is akin to building a soccer pitch on a slope where one side has been built up over many years. Even if there’s no soil being added to the hill right now, it doesn’t change the fact that one half of the field will start off much higher than the other.

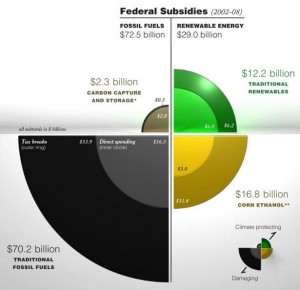

Let’s take a look at the numbers. Averaged over the lifetime of a subsidy, fossil fuels receive $4.86 billion annually; nuclear, $3.50 billion; biofuels, $1.08 billion; and all other renewables, $0.37 billion. Somewhat pathetically, the most renewables have ever received in government assistance is still less than oil and gas did during the Great Depression. The difference in subsidy amount is also compounded by the fact that fossil fuels have been receiving government money for almost a century, but renewables weren’t significantly subsidized until the Energy Policy Act of 1992.

In a balance tipped so far to one side, how do you try to correct it? Well, for starters, you maintain the funds going into renewable energy, which is a great example of the types of dynamic newly developing technologies that subsidies are intended to help spur. The renewable energy industry grew at a rate of about 11% from 2003-2010 – well above the national average of 4.2%. The wind industry alone supports 80,000 jobs spread throughout the US and has an annual growth rate of 35%. Yet it appears that the major subsidy that helps the wind industry – the production tax credit, or PTC – will not be extended by Congress before it expires at the end of this year. The PTC has been allowed to expire three times in the past and wind installations dropped 73-93% in the year following – with large job losses. The solar industry’s major subsidy, the investment tax credit, also expired at the end of 2011.

Meanwhile, subsidies for fossil fuels – which are permanent parts of the tax code and do not have to be renewed – come in each year for an industry that made a collective $137 billion in profits in 2011. The industry can hardly be considered developing, and it’s therefore appropriate to ask if corporations should be taking tax credits for investments in energy they’d be making anyway when federal assistance for renewable energy is being cut.

Congress must take a serious look at the role and purpose of subsidies in the energy industry when tax reform comes up, most likely in the 113th Congress. They should continue to provide support for developing technologies in the renewable energy industry, while revisiting the effectiveness of subsidies for the mature fossil fuel industry and cutting any wasteful handouts. A “level playing field” won’t be created by designing better catchphrases in debates, but by politicians who are willing to break out the shovels, get a bit dirty, and start filling in the lopsided market themselves.